Learning From the “Outside In”

I’ll never forget the day my Product Marketer caught me off guard. It was his first week, and he’d asked how our latest product — an integration with Facebook — was performing. I told him it was a success, mainly because clients had bought it at a good price.

Then, more pointedly, he asked, “How many people have used the feature this month across all clients?”

Embarrassingly, I had to admit that I didn’t know. As Head of Product and Engineering, I should have known this for one of our top products.

The Product Marketer wasn’t trying to make me look bad. He was genuinely trying to learn about the company, the product suite, and the customers — from the “outside in.”

He wanted hard facts, not just my opinion. He also reached out to current customers to hear their thoughts on our latest products.

How to learn about your product and your company:

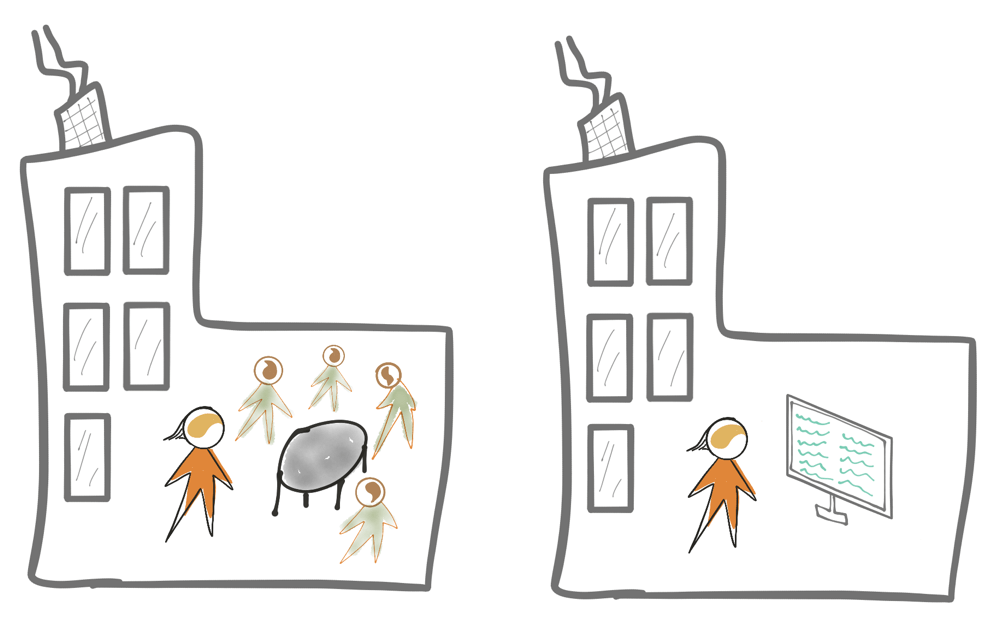

Learning from Primarily Internal Sources

“Outside In”: Customer Interviews and Conversations

“Outside In”: Interview Script

“Outside In”: Metrics & Analytics Data

“Outside In”: Other Data

Learning from Primarily Internal Sources

Not everyone uses an external lens, an “outside in” approach.

When product managers, designers, engineers, and leaders join a company, I see them dive mostly into internal resources to learn about their product.

They read the wiki…the release notes…talk to various stakeholders…absorb the data produced by everyone at the company.

In the wiki, you’ll find the long history of all products. But most documentation is out of date the moment it’s written down and can lead to several dead ends. That said, documents that catalog the successes and failures of past attempts can be very informative.

From stakeholders, you’ll hear their opinions on the current product and potential future directions. Many of these stakeholders have history with the company and intuition in the domain. They can provide valuable context. However, stakeholders can contradict each other, be influenced by internal politics, or lack a solid basis in data.

Gathering so much background information at once creates a massive synthesis challenge for you as you try to make sense of years’ worth of documents and opinions.

Of course, not all documentation or stakeholders will lead you astray, but they shouldn’t be your only sources for understanding a product’s current success or failure.

“Outside In”: Customer Interviews and Conversations

“Outside-in” learning isn’t as exhaustive as internal research, but it provides a range of customer-focused snapshots. Because interviews are time-boxed, they zero in on the most critical issues rather than covering everything. They also serve as a gauge for client sentiment, often answering the question, “What have you done for me lately?”

The “outside in” perspective provides a compare and contrast to the information you’ve been collecting internally. For example, do stakeholder priorities reflect the top user concerns?

Interviewing customers when you’re new and unfamiliar with the product may seem daunting. However, as a Product Discovery Coach, I do this every week. I’m often brought into companies to coach discovery in areas I don’t specialize in, like CRISPR genetics, cryptocurrency, or financial reporting platforms.

Using a script (but not strictly adhering to it) can provide new interviewers with a playbook to get started and develop confidence over time.

For this “outside-in” learning, we’ll focus specifically on B2B products.

These questions can be asked remotely or in person. As with all interviews, you don’t need to ask each question exactly as written. You may choose to dive deeper into certain sections or skip others altogether. That said, I always ask the final question on the list.

It’s important to note that the interviewee may only be the buyer, not the end user. You’ll identify this early on with the second question. From there, be cautious of hearsay, as buyers might share their impressions of product usage rather than firsthand insights. Conversely, end users might not fully understand the broader impact of your product on their company.

It’s okay to focus on the specific experiences that this interviewee has had with your product. Don’t allow the interviewee to speculate about what they would do. Stick to their past experiences for the most reliable data. Customers and end users often have a limited, sometimes fragmented, view of your product. To your company, your product is everything; to your customers, it’s likely just one part of their workflow.

“Outside In”: Interview Script

When conducting these “outside in” interviews, I recommend doing this in person or over the phone. A survey will not suffice. For each you get, you’ll likely want to ask a follow up.

Link to this script in an easy to copy Google Doc.

The interviewee

Role → Please describe your role at your company.

Collect a Story → Tell me a story about the most recent time you used our product.

Learn about the product from the “outside in”

Product Usage & Frequency → How often do you use the product, and in what specific contexts or scenarios?

Workflow & Integration → How does the product fit into your workflow? Are there other tools you regularly use alongside it?

User Experience Feedback → How would you describe the user experience of our product? Any specific areas you feel could be more intuitive or efficient?

Key Features & Value → What features do you find most valuable? Are there any features you don’t use or find unnecessary?

Pain Points → What challenges or frustrations, if any, have you experienced while using the product? What, if any, workarounds do you still use even when using our product?

Problem Solving → How well does the product solve the problems you initially adopted it for? Are there any areas where it falls short?

Desired Improvements → Are there any specific improvements or new features you’d like to see?

Vision & Strategy → How do you feel about the direction our product is going in?

Learn about your company from the “outside in”

Pace of Change → How would you rate the speed of our product development process?

Support & Resources → How do you find our resources, like customer support, documentation, or tutorials? Are they helpful and accessible? Do you have any outstanding issues that we have not resolved?

Choosing a Vendor → Why did you choose our company and product? What problem does it solve for you? What opportunity does it create for you?

Competitive Comparison → Have you used or considered similar products? If so, what aspects of our product stand out, and where do you see room for improvement compared to others?

Learn about the customer’s company

Outcome & Business Impact → What measurable outcomes have you seen from using our product? Has it impacted your efficiency, effectiveness, or any key performance indicators?

Business Climate → What is the #1 problem facing your business not related to our product line?

“Outside In”: Metrics & Analytics Data

You should also get access to usage data (eg, clicks/taps, screens visited, frequency), milestone metrics like completion and conversion rates, and high-level figures such as revenue and gross margin.

There are many other data sources available, but the key is to examine the product from the perspective of the value it delivers to customers — not just the value your company hopes they receive.

“Outside In”: Other Data

There are plenty of other ways to learn about your product from the “outside in” including but not limited to:

Tech support calls

Sales calls

Business development calls

Account management/Customer Success calls

Implementation calls

Customer feedback surveys

Social media conversations

Online ratings and reviews

Interviews with end users of competitive products

Customer user groups (facebook, Discord, etc)

Channel partners

Learning about your product and company from the “outside in” provides a fresh perspective that complements internal research and conversations.

Jim coaches Product Management organizations in startups, growth stage companies and Fortune 100s.

He's a Silicon Valley founder with over two decades of experience including an IPO ($450 million) and a buyout ($168 million). These days, he coaches Product leaders and teams to find product-market fit and accelerate growth across a variety of industries and business models.

Jim graduated from Stanford University with a BS in Computer Science and currently lectures at University of California, Berkeley in Product Management.